After a full year the coronavirus pandemic is still affecting small businesses around the world. Too many small businesses feel they have exhausted all of their resources and options. Some businesses resources provided financial assistance – at some level – at the beginning of the pandemic. But, a year later there is a greater need for additional small business financial solutions. Below are some of the flaws with the traditional financial solutions and alternatives to continue to improve your business.

After a full year the coronavirus pandemic is still affecting small businesses around the world. Too many small businesses feel they have exhausted all of their resources and options. Some businesses resources provided financial assistance – at some level – at the beginning of the pandemic. But, a year later there is a greater need for additional small business financial solutions. Below are some of the flaws with the traditional financial solutions and alternatives to continue to improve your business.

Sources of Additional Small Business Financial Solutions

Traditional

Before the pandemic, starting and growing a business generally consisted of using personal finances, raising capital, getting a small business loan, or some combination of the three. However, these options were all put under great strain during the pandemic as businesses had to pivot or close.

The US government offered Paycheck Protection Program (PPP) loans and grants to help keep businesses afloat. Unfortunately, the competition for these limited funds was extremely high and the application process complex for small businesses. The criteria to qualify for it meant that large, nationally-recognized corporations got the bulk of the relief money. Many small, local businesses were completely left out of the first round of funding.

Additionally, the application and approval processes were not fast enough in many cases during the hardest parts of the coronavirus shutdown. Although these traditional options are still possible, and there is potential for more government support, high competition and long wait times are expected.

Alternative

If you’ve exhausted the more traditional options or need an influx of cash while you wait for a more traditional option, here are a few ideas to help.

With the desire of many to help support small businesses, crowdfunding can be a good option. Although crowdfunding relies on the generosity of others, it is low risk in the sense that money does not have to be returned or paid back, but many view it as paying it forward into their community. There are many platforms now that have streamlined this process as well.

Another option for homeowners is to use their equity built up with a home equity loan or home equity line of credit. As a lump sum based on the total equity you’ve built, a home equity loan generally has a lower interest rate than a personal loan because your home is the collateral. In comparison, a home equity loan line of credit allows you to cover expenses and purchases over a period of time where you pay back what you spend, with the equity as your credit limit.

Finally, if you’re a savvy budgeter, a business credit card may help support you during the pandemic. Although building up debt is always scary, many business-specific credit cards offer great perks and rewards to help offset the worry. An option like this does allow for consolidation of debt down the line and flexibility right now. It’s important to remember that the rates on these cards can be very high, so it is not a long term solution without other money and financing options as well.

How to Spend Acquired Small Business Financial Solutions

Build Your Online Presence

Traditional Online Strategies – Google and Social Media Ads

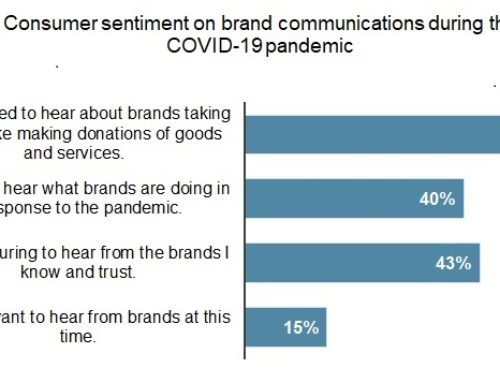

With everyone at home more, conducting business online has become the standard rather than an option. Before you throw all of your marketing budget into Google and social media ads, consider what you are paying for. Free forms of exposure, buzz, and social media can only get you so far. Generally, those free versions you use for marketing are not very targeted for your ideal customers.

When you pay for a Facebook or Google ad or an influencer post, you get the initial impression or even a click, but you are essentially paying for it directly. While, of course, you can factor that cost into the price of your offering, it is a cost that must be considered every time. In some cases, if you don’t pay for this placement, ideal interested customers will not see your ad at all. And, paid advertising allows you to reach specific audiences who fit your ideal customer profiles far better and social media posting.

Alternative Tools – SEO, UX, and Content

Rather than focusing on temporary and paid conversions, think of the components of your online presence that will lead to sustainable value. Investing in something like search engine optimization (SEO) or taking the time to implement SEO practices on your own helps you get found on Google through its organic results. Once you organically rank, you are no longer paying for every click directly.

Additionally, putting time and money into your content development, web design, and user experience translates into customer retention and long-term relationships. If someone clicks on your Google ad, but your site is hard to navigate or isn’t what they were searching for, you’ve paid for the click with no conversion of prospects to customers.

User Experience (UX) is the next higher step from basic customer service. What kind of buyer experience do you provide to your customers that gets their attention? Just ‘OK’ isn’t enough. You need to think about every touchpoint a prospect has when they do research, find you, and engage with your firm. Develop a UX that they want to talk about to friends and family.

Delivery

Traditional – Third Party Delivery Services

When third-party shopping and delivery apps first came on the scene, they were marketed as a convenience. With the pandemic, these apps and their workers were deemed essential. However, some of the most “convenient” choices for customers were actually hurting businesses greatly.

Restaurants in particular, which generally operate on lower profit margins already, were paying 30% to larger, name-brand delivery apps. Services like Grubhub, DoorDash or Uber Eats can deliver meals to your customers, but it will cost you.

Even traditional and trusted delivery methods like good old snail mail and couriers struggled to operate smoothly during the holiday season. Demand was extremely high, their workforce reduced and miscommunication between services. Of course, sending products across the country is essential for many businesses. This means small businesses need to be sure to communicate with customers and be upfront about delays and issues, whether internal or external.

Alternative – Local Delivery

If you have a retail operation with products that can be delivered locally, try setting up your own order delivery. Or, think about setting up a curbside pickup service. Costs for providing your own delivery service can save you money you probably need right now.

It may seem easier for your firm to be found on lists those well-known delivery apps put out, but the costs remain high. Remember, many people are actively looking to support smaller local businesses. This means they will put in a little extra effort to support you. A study from EY (Ernst & Young) showed as consumer preferences and personas change during the pandemic, 34% would spend more for local products.

Additionally, these new tasks allow you to retain some retail and part-time employees as expeditors and delivery drivers in your local area. Many employees cannot perform their normal duties under current government coronavirus PPP guidelines. This model allows you to design the cost and fees around what it actually costs you to make a delivery, versus paying crazy margins to third parties. And, tips go directly to your employees.

A Changing Workforce and Workplace

Traditional – Full-Time, in the Office

Before the pandemic, companies with remote workers were few and far between. Some even viewed employers implementing remote working as being cutting edge. Working full-time in an office, studio or retail environment is so normal. Until forced to experience it, pros and cons of remote work never came up for consideration. Of course, in-person collaboration, centralization, and stepping away from distractions at home are great benefits. Being in an office close to other employees or customers is now thought to be unsafe during the pandemic.

Social distancing was never an issue before the pandemic hit. Many companies had to pivot and fight a huge learning curve to transition from in-office to remote work online. Some businesses will always be better fits for an in-person workplace environment. That said, taking time to put measures in place for remote working are not just beneficial for the current pandemic. Remote working may well become an option you can offer employees down the line in a hybrid office-remote work model.

Alternative – Remote and Flex Work

The shift to remote work may have been forced at the beginning of the pandemic. But, many companies are now reconsidering ever returning all workers to the office. Remote work allows businesses to hire and collaborate with talent across the country and even around the globe. This pandemic situation reveals which job functions are the best for full-time, part-time, or temporary employees. Newly recognized flexibility and agile workflow allows companies to tailor the jobs and tasks to their actual needs. Another, more obvious benefit is savings on office and retail space costs. As many people become accustomed to remote work, they will learn how to navigate the process. Even when businesses are back open, some will realize what a great advantage remote working is.

Conclusion

Of course, every industry will see pros and cons for each of these solutions. In some cases, the traditional solutions may still seem to be the best options. The pandemic hit upon us so quickly and unexpectedly. We are only now beginning to analyze the options and solutions taken on to keep businesses alive.

Of course, every industry will see pros and cons for each of these solutions. In some cases, the traditional solutions may still seem to be the best options. The pandemic hit upon us so quickly and unexpectedly. We are only now beginning to analyze the options and solutions taken on to keep businesses alive.

At some point, we will see positive and negative issues that came with all ‘solutions’ implemented during this disaster. Only then will small business owners decide what good came from the experience and can be used moving forward.

To determine what is most suitable for your business’ unique problems, don’t be afraid to ask for help from an outside perspective. If you were smart and alert, your small business will survive. It may be an uphill battle, but pivots in new directions will get you back to where you were.