‘Designing Strategies’ Newsletter

July – Aug 2016 Volume 13 — Issue 72

Do you ever think about the stage, or phase, your small business enterprise is in, or has passed through? We are all aware of when our family members and friends birthdays are. We celebrate anniversaries, graduations and other of life’s watershed moments. We celebrate in a big way with parties, gifts and major events to celebrate these great moments as we move through different stages of our lives. Small business growth stages aren’t much different.

It seems that our small businesses, into which we have poured our hearts, souls, time, energy and money, deserve at least the same milestone recognition. After all, it is the business that creates the profits that pay for those celebrations. Your company should receive at the very least, some thought about where that small business has come from, and what growth stages it has passed through and achieved. It is also important to know what next step(s) will be coming as it reaches maturity.

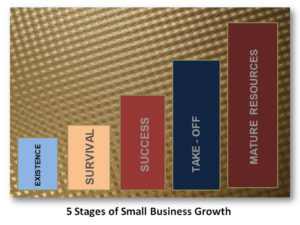

5 Small Business Growth Stages

There are five distinct business stages that every small business owner should be aware of, even if only in the back of your mind. Each stage clearly indicates the level of importance for a number of elements that are influenced by the business owner(s). Knowing what each key element is and how you should, or should not, be involved is critical for the successful growth of your company. You started with an idea; thought about it, shaped it, expanded it, and gave it a little bit of polish. When you got to what you felt was the “It’s Perfect!” stage, you launched it. That is when the fun began – or at least that’s what you thought, back in the beginning.

Small Business Growth Stage 1: Existence

You’ve done some thinking and hopefully, more than a little bit planning about how to get your business up and running. You decided the type of business you will operate: retail, manufacturing, services, or e-commerce. You set up a legal format: sole proprietor, partnership, LLC, or one of the corporate options.

You’ve done some thinking and hopefully, more than a little bit planning about how to get your business up and running. You decided the type of business you will operate: retail, manufacturing, services, or e-commerce. You set up a legal format: sole proprietor, partnership, LLC, or one of the corporate options.

Ideally, you consulted with a legal and financial expert to help you select the best options for your business and your personal situation. Maybe you needed a vendor’s license to sell something. You ordered business cards. Maybe setting up a website was Step #1 for your business. Whatever it was, you did it and were ready to hang your shingle or sign above the door.

At this point, you likely operated on cash from your, or family and friends’ savings and credit cards. Not very many small business startups set out with a bank loan or money from a venture capitalist or angel investor. YOU are in charge – mainly because you are likely the only person involved. You might have a partner or hired an assistant, but YOU are in charge of your small business. YOU make all the rules. YOU make all the decisions. YOU decide what policies will rule the business.

If there is an assistant or other staff member, you are still the one making decisions for them to undertake. Everything is done YOUR way because it’s your business and you are in charge of decisions about everything. You are in control of all financial issues: what to buy, how much to spend, how and when purchases will be paid for. Without staff to oversee, your supervisory capacity has no reason to exist. Formalized systems for getting things done probably don’t exist, except maybe in your mind. Your sole strategy in Stage 1 is to make enough money to keep the lights on and the door open.

Small Business Growth Stage 2: Survival

In Stage 2, the Survival phase, you probably feel comfortable enough to let out a sigh of relief and tell yourself: “I’ve made it!” At least the lights are still on and the door remains open for business. Customers and sales have increased. Along with the much-improved cash flow, the work load to make your product, distribute and sell your product or services has grown as well.

In Stage 2, the Survival phase, you probably feel comfortable enough to let out a sigh of relief and tell yourself: “I’ve made it!” At least the lights are still on and the door remains open for business. Customers and sales have increased. Along with the much-improved cash flow, the work load to make your product, distribute and sell your product or services has grown as well.

Although it is a nerve-wracking thought, you think about maybe hiring some help. You’ve been working 60 or more hours a week, your bank account is low, but you can finally pay yourself and pay relatives back some of those loans. With luck, your family is still talking to you and truly understand the reasons behind the many hours you were away from them, It’s time for you to cut back and let someone else help carry the workload.

In this Survival stage, you remain ‘large and in charge’ of pretty much everything. Your main strategy is to Survive and not lose ground. You proved that your small business idea works. Customers are buying what you are selling. You still have not given up any control or convinced yourself that it’s OK to delegate. Even if you finally gave up the reins a little bit and hire people to help with supervision, it’s likely that you are still personally supervising the supervisors. Everything still goes through you. You need to let go. It’s time to let go with the need to control everything. Hire good people and trust them.

Formalized systems are still pretty minimal in Survival phase. An interior designer I know started her design business. It grew quickly. She was thrilled that she had clients and was making money. One day, a call came from her banker, alerting her that her bank balance was low and checks were bouncing. She was shocked. She knew she was working hard for good, happy clients who were promptly paying their bills. How could this be happening? She looked in her desk drawer and found a stack of client checks, still waiting to be deposited into her account! No formal system was in place for handling inflow of cash from the client, to her mailbox, through the bookkeeping system, and to the bank.

Small Business Growth Stage 3: Success

The Success Stage affords small business owners the most flexibility of all the growth stages. There are options and breathing room to consider what to do next. Your company has achieved stability; financial stability at a reasonable level of profits. Less stress occurs at this point over cash flow and paying the bills.

The Success Stage affords small business owners the most flexibility of all the growth stages. There are options and breathing room to consider what to do next. Your company has achieved stability; financial stability at a reasonable level of profits. Less stress occurs at this point over cash flow and paying the bills.

You have succeeded in terms of gaining and controlling a good share of the market. You have satisfied, profitable customers and have built solid relationships with key vendors. You have the resources now to afford staff to assure customers are satisfied and keep coming back. With staffing comes the need for formalized policies, procedures and systems. Everyone is on board and moving in the same direction. At this stage strategic planning takes on more importance for managing and operating the business.

Are you comfortable enough to stick with the status quo – just keep on doing what you have been doing? You can remain at that size, in terms of staffing, facilities and finances. Maintaining the status quo is not the only option open to small business owners who have reached the Success stage. There are two other very different directions to be considered at this stage of the game.

Choices Mid-way Through Small Business Growth Stages:

That rock song, “Should I Stay, or Should I Go?” sums up the Success stage of small business growth nicely. Once Success has been reached and enjoyed, small business owners can be faced with that monumental question: “Should I stay or should I go?” Remain at the status quo, sell off the company, or keep on growing the company? There are so many positive options to choose from at this stage.

A small business at the Success stage can be an attractive product to sell. Could this be the right time to take your rewards, sell the business and retire to a small island with palm trees and sandy beaches? This is a great opportunity to capitalize on some exciting new venture you’ve been thinking about for a long time if you aren’t ready to retire.

Just keep on keepin’ on, sell and move on, or take on challenges in new directions? Options exist at this point. If a small business owner opts for the ‘Stay’ option, decisions need to be made. Should you keep the business operating at this level of success? What strategies can make that happen? Does continuing to grow the business sound compelling? How will you be involved in that growth to Stage 4: Take-off? Strategic thinking and planning becomes more important than ever at this point.

Small Business Growth Stage 4: Take-Off

The biggest question for a small business owner/founder to ponder at this stage is: “Am I the right person to take this company larger?” Often, the honest answer will be: “No.” Management and delegation are critical elements at this level. Some staff who helped get your business to this point may not be the ones to take it higher. Owners often are great at some skill and decide to build a business around it. What they likely do not excel at are business management and growth strategies.

The biggest question for a small business owner/founder to ponder at this stage is: “Am I the right person to take this company larger?” Often, the honest answer will be: “No.” Management and delegation are critical elements at this level. Some staff who helped get your business to this point may not be the ones to take it higher. Owners often are great at some skill and decide to build a business around it. What they likely do not excel at are business management and growth strategies.

Systems that went from basic to functional should be moving into a more mature format. By this point customers are more established and developed; as are sales and distribution processes. Products and services have grown and matured through the various growth stages and need more mature systems to keep things happening in productive and smooth operations. As customers and staff come and go, things need to operate the same way. It is more important than ever that everyone on board moves in the same direction using the same systems and procedures.

The Take-Off stage requires new strategies and financial backing to continue growing successfully. Can the company continue to grow in the same location? Perhaps more space or multiple locations will be a better solution. Will customers be better served through a single mega small business or a number of smaller, specialized bases of operation spread across the country or around the globe? Certain product and service lines might be spun off into separate entitles. Can technology help the company grow financially without having to greatly increase the number of employees? How can outside influences affect how you can and will do business? The day-to-day functionality approach of doing business changes greatly upon entering this growth stage.

Small Business Growth Stage 5: Resource Maturity

Your Take-Off stage was successful. You are now a bigger small business, playing in the big leagues. Staffing has grown; specialization requires a human resources system. Processes and systems have reached a high level of maturity. Some of the functional sections of your company have now grown to divisions.

Your Take-Off stage was successful. You are now a bigger small business, playing in the big leagues. Staffing has grown; specialization requires a human resources system. Processes and systems have reached a high level of maturity. Some of the functional sections of your company have now grown to divisions.

The simple bookkeeping system from the early stages has grown. Now, you need tax experts, a director of finance, Chief Financial Officer, or a controller. The one or two staff members who helped you through the early stages of business growth have now multiplied. They are more divided into functional departments. Finances now allow for hiring more staff, improving the company workplace and adding technology to keep the company growing.

Strategy is critical at this phase, and requires input from the various business divisions and departments to be successful. Management and leadership hires are critical in planning the strategies that can move the company forward. You may think of your small, but mature business as a large business at this point. But, according to US law, so long as your staff numbers are below 500, you are still considered to be a small business. Next stage – Big Business? So many decisions, so little time.

As a small business grows, moving through various stages of development and maturity, the founder and business entity both face changes and challenges. Financial situations change and staffing grows. Management and supervision can no longer be done by just one person. Processes and systems need to grow with the company to assure standard methods of operations that will keep the company running in a smooth, productive manner.

Business resources need to be watched and controlled as the company expands. It is important to keep your finger on the pulse of customers, suppliers, market share, technology and other resources. Be aware of the changes in your company as it grows. Be alert to changes happening around your business everyday that can affect it – for better or worse. Know your own capabilities when it comes to growing your business and be willing to bring in more experienced help when it is needed.

Wishing you wild, crazy success as you move your small business toward bigger and better things.

VISUALIZE — ANALYZE — STRATEGIZE

Your Company’s Plan For Success!

This ‘Designing Strategies’ publication is brought to you compliments of Terri L Maurer, owner of Maurer Consulting Group. MCG is a management consulting firm working with small business owners and managers, helping them get out of ruts that slow their progress, and focus their sights on growth and success. In addition to helping small businesses focus on growth and success, Terri is an author, publisher and speaker, presenting seminars, training and keynote speeches.

To schedule time to talk with Terri about how she can help you identify what elements of your business are holding you back, call her at: 330.283.3999, or send a direct email . Visit the MCG website to learn more about our services.